Import of Goods

Due to the fact that producing certain products is either not possible in some countries or is not economically viable, these countries must rely on imported goods to meet their needs. The act of bringing goods produced in one country into another for commercial purposes is referred to as the "import of goods." The annual needs of each country are determined by trade policymakers through policies such as tariff regulations. Having a good command of international trade laws is essential for the import of goods, and the Gazdarazi Trading Company can be a reliable guide and partner for you in this field. Stay with us in this article as we delve into the details and processes of importing goods.

Types of Import

In general, there are two types of import procedures. The first type is direct import, which occurs through air, land, and sea transportation to Iran. In the second type, due to sanctions, the direct import of goods to Iran is not possible, involving countries such as European nations, some Chinese companies, Korean companies, etc. In such cases, intermediary countries like Dubai are sometimes used to import sanctioned goods. Collaborating with Gazdarazi Company enables you to carry out the import process in the easiest way possible, whether directly or indirectly, with no limitations.

Import Companies

Generally, all goods that are brought into a country via air, land, or sea routes are referred to as imported goods. The necessity of importing goods in each country is determined based on that country's conditions. These conditions can include climatic and environmental factors. For example, countries with moderate or cold climates lack the capability to grow and produce tropical fruits and plants, so they need to import them from other countries. Other influential factors include land capability, availability of human resources such as workers and specialists, and so on.

Trade always requires precise knowledge of regulations. The laws and rules regarding the import of goods are usually updated and adjusted according to current needs and various conditions. An import company must have full knowledge of all the laws and regulations governing the import of goods into the country. To import goods, one must have complete information about trade, international transportation, international banking, customs procedures, cargo clearance, currency allocation, and other related matters. Generally, mastery of import regulations falls within the specialized scope of trading service companies. With 15 years of experience, Gazdarazi Trading Group offers unique services in this field.

Complete Import Process: From Order Registration to Customs Clearance

The import process is a complex procedure that requires precision and careful planning. It begins when the decision to import goods is made, and the importer must prepare all the necessary documents and paperwork to proceed. Part of the import process takes place domestically, while another part occurs abroad, each with its own complexities and requirements. In essence, the import process involves many steps but can be divided into two main phases:

Phase One: Purchasing and Shipping Good.

This phase includes the following steps:

- Correspondence and request for quotes and prices.

- Requesting product information, such as catalogs and seller profiles.

- Negotiating with the seller.

- Reviewing the supplier company.

- Finalizing the order and obtaining a proforma invoice.

- Payment of costs.

- Quantitative and qualitative inspection of the goods.

- Choosing the mode of transportation.

- Loading the goods.

Phase Two: Customs Clearance

This phase includes:

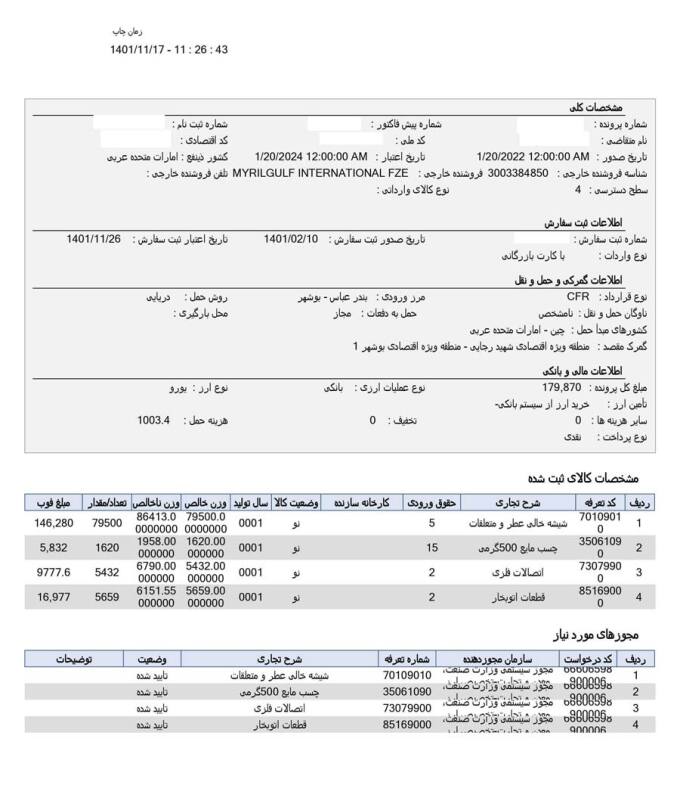

- Registering the order.

- Obtaining the required permits.

- Receiving the cargo entry declaration at customs.

- Paying costs such as customs duties and taxes.

- Receiving the goods.

Obtaining a Business License

The first step in the import process for new traders is obtaining a business license. This license is issued by the Ministry of Industry, Mine, and Trade (Ministry of IMT) and the Chamber of Commerce and comes in various types, including commercial, industrial, and one-time licenses. The license can be issued in either individual or corporate forms.

Choosing the Scope of Activity

The scope of activity can be selected and defined in several ways. Some traders work exclusively with a specific country, importing various types of products from that country. Others focus on importing a specific type of product from different parts of the world.

Familiarity with Updated Rules and Regulations

Importers must have complete knowledge of the laws, directives, and various considerations in the field of goods importation. For instance, they need to be informed about the prohibition of importing certain goods, changes in import tariffs, or restrictions on trading with specific countries.

Another critical point to emphasize in this context is the prevention of goods accumulation in the country’s customs. This is important because several steps (such as order registration, currency allocation, etc.) need to be completed before the goods arrive at customs. Additionally, the relevant permits must be promptly obtained to prevent the goods from being held at customs and incurring losses due to delays.

To minimize this issue, it is essential to stay in contact with your trade consultant, who can handle the clearance of your goods as quickly as possible.

Choosing the Country and Imported Goods

At this stage, negotiations need to be conducted with various clients from different countries. Familiarity with the trade regulations of these countries is essential for this purpose. Note that in addition to the price and quality of the goods, it is also necessary to review the technical specifications of the goods, determine the quantity and type of the goods, and so on.

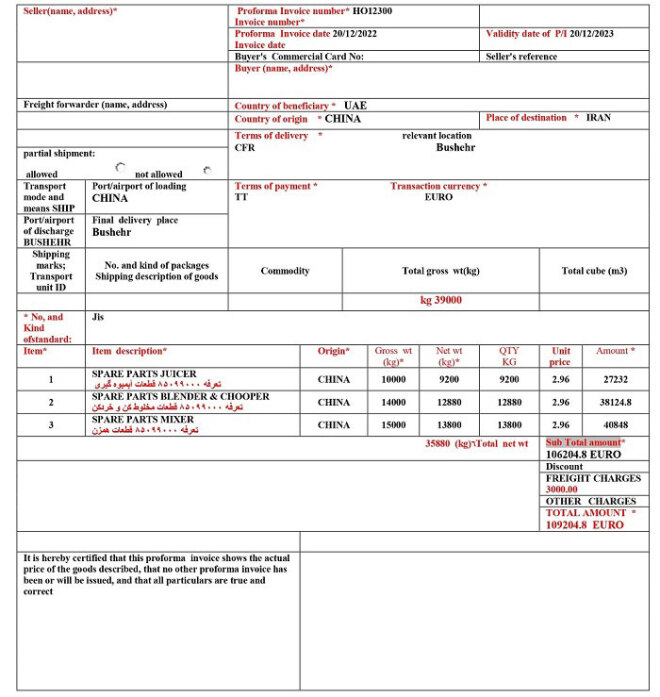

Requesting a Proforma Invoice

After completing the initial agreements, to purchase goods, you must request a proforma invoice (pre-invoice) from the specific seller. The proforma is a fundamental and critical step in the import process, and all information must be accurately and comprehensively included in it. The proforma is also used for order registration, and this document serves as the basis for submitting the order registration request. The mandatory information to be included in the proforma includes:

- Price

- Freight charges

- Quantity

- Weight

- Country of origin and destination

- Currency type for the transaction

- Details of the seller and buyer

Order Registration

At the order registration stage, the importer must visit the Ministry of Industry, Mine, and Trade’s order registration system (Integrated Trade System) and submit their request for importing the desired goods. Typically, the order registration process varies depending on the type of goods. In some cases, in addition to the Ministry of Industry, Mine, and Trade's approval, obtaining permits from other relevant authorities is also required for importing specific goods.

Currency Allocation and International Payment

Currency procurement is carried out through several methods

Preferential or Government Currency

The government allocates subsidized currency to essential items such as food and medicine:

NIMA Currency:

In response to the currency crisis, the government established the NIMA system to allocate currency for non-essential goods, allowing importers to obtain currency through it. Other methods include currency exchange, banks, documentary drafts, and letters of credit.

Transportation and Insurance of Goods

Goods transportation is conducted through various methods. The buyer and seller choose a transportation method using international Incoterms rules. Each rule entails different levels of risk for the buyer and seller. Generally, both parties agree with an insurance company to insure the goods, which requires payment of an insurance fee.

Import Costs

In a general sense, the costs associated with importing goods typically include the following:

- Cost of purchasing the product

- Quality inspection fees

- Transportation services

- Freight insurance

- Product inspection fees

- Storage fees

- Customs duties

Customs Clearance

Once all import stages are completed properly, the goods arrive at the destination country's customs. The importer must submit the goods' documents and paperwork to customs through their representative. After completing various procedures and paying the required fees, the goods are cleared. Customs clearance is one of the most critical steps in the import process, and importers often rely on official customs brokers to complete this stage.

Importing with ATA Trading Group

One of the advantages of working with ATA Trading Group for traders is the expertise of our specialists in import-related matters. This expertise ensures that all necessary steps are carried out seamlessly, without any concerns. Furthermore, obtaining permits that are sometimes highly complex becomes a straightforward task with our assistance.

The various processes defined by the ATA team for import-related tasks are highly systematic and organized. Ultimately, it is important to note that our primary focus is on saving time and reducing costs for you to conduct a profitable trade.